who claims child on taxes with 50/50 custody michigan

If the non custodial parent submits the form 8862 to claim the child for that tax year do they get the full tax credit benefit that the custodial parent. Both parents try to claim a child.

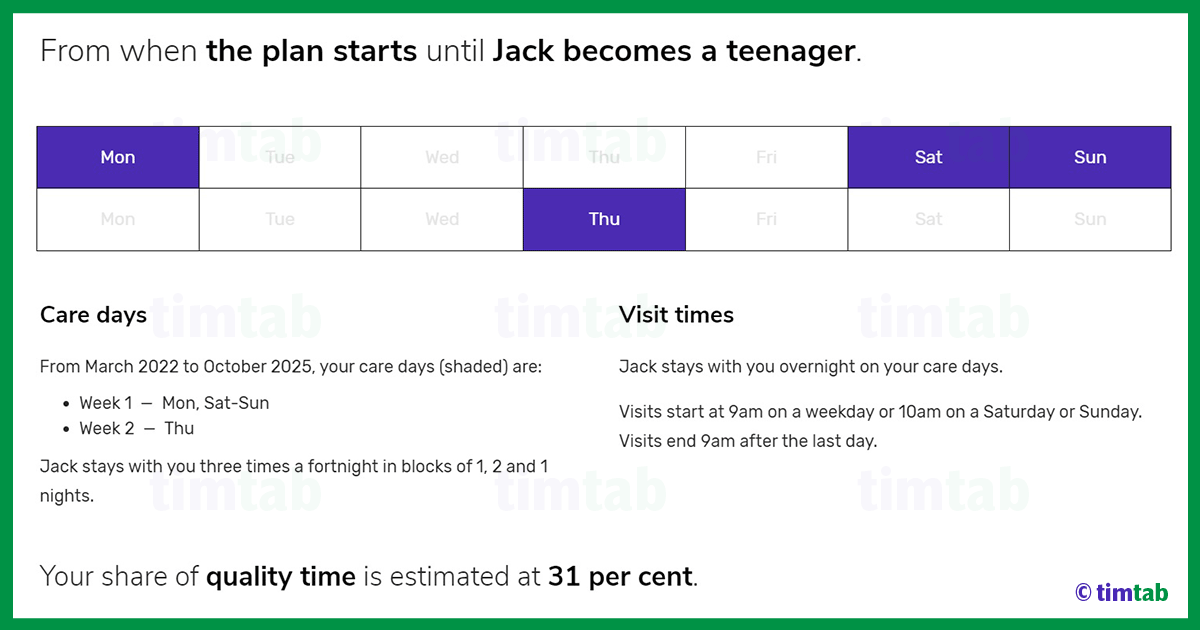

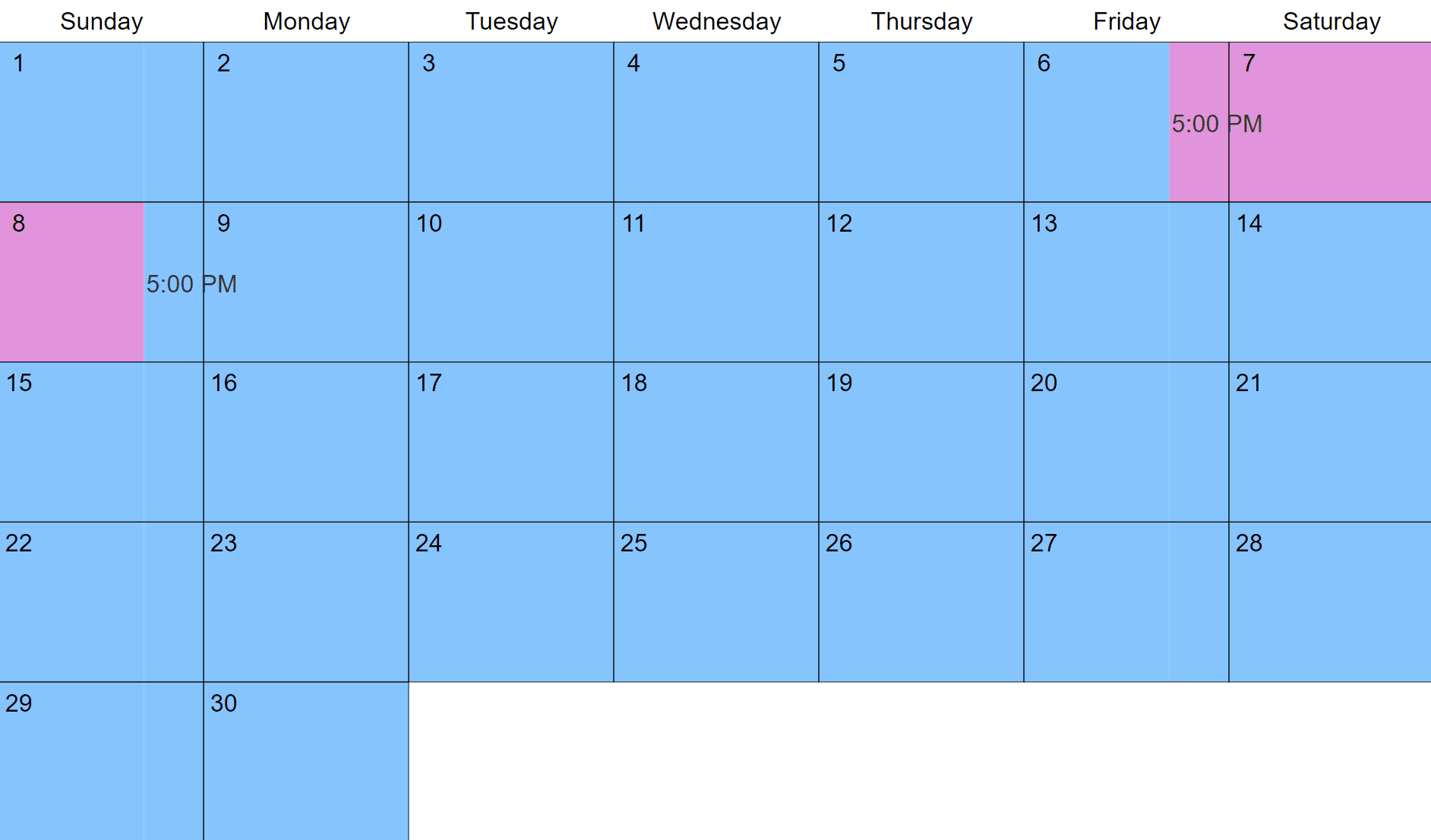

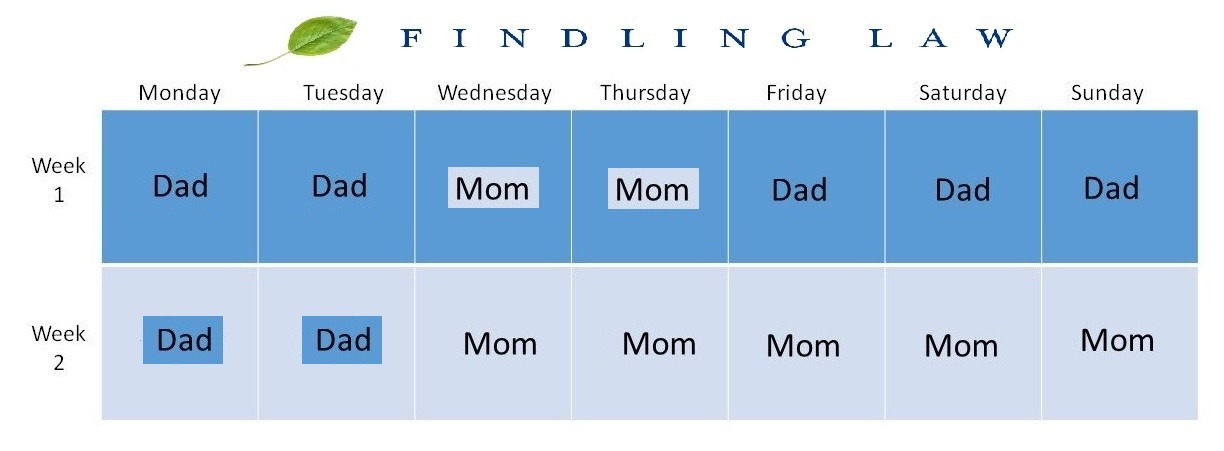

What Does A 50 50 Or Joint Custody Agreement Look Like

The Internal Revenue Service IRS typically allows the parent with whom the child lived most during the tax year to claim the child.

. Who can claim a child ontaxes in a 5050 custody agreement. If you do not file a joint return together but both of you claim the child as a qualifying child the IRS will choose the parent with whom the child lived for. Who Claims a Child on US Taxes With 5050 Custody.

This seems straightforward enough but of course there are exceptions to the. However if the child custody agreement is 5050 the IRS allows the parent with the highest income to claim the dependent deduction. When parents divorce or separate the law allows only one of them to claim their child as a tax dependent.

Our firm has more Super Lawyers than any other organization in the Lone Star State. Parents can also come to a mutual agreement regarding which of them will claim the child when filing for taxes. On the year that mom doesnt get her she has to pay single with no dependents.

The custodial parent as defined by the IRS claims the child tax credit in a 5050 division. A release has been signed. A custodial parent will often make an argument on behalf of hisher joint physical custody of their child in most cases.

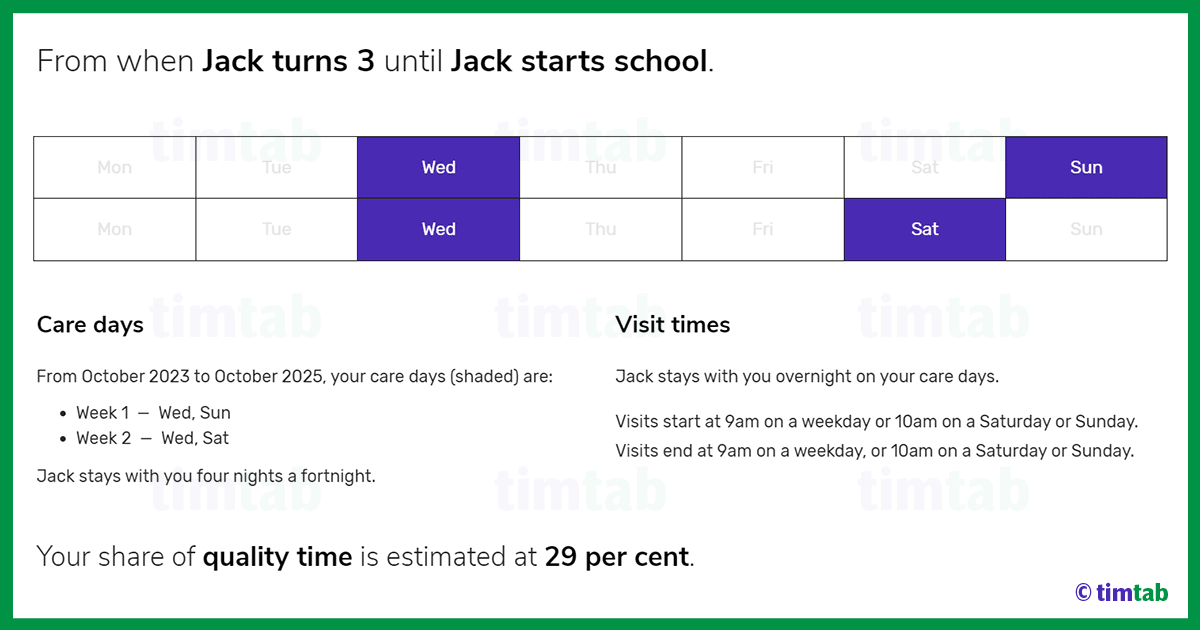

In cases where custody is split exactly 5050 the parent with the highest income gets the benefit explains Hoppe. Often in the case of 5050 custody and similar financial contribution from the parents the court orders that the parents take turns in claiming for the child. Who Claims the Child if Both Parents Have Similar Incomes.

When You Have 5050 Custody Who Claims The Child On Taxes. It is their choice to do so. Even still the IRS policy remains.

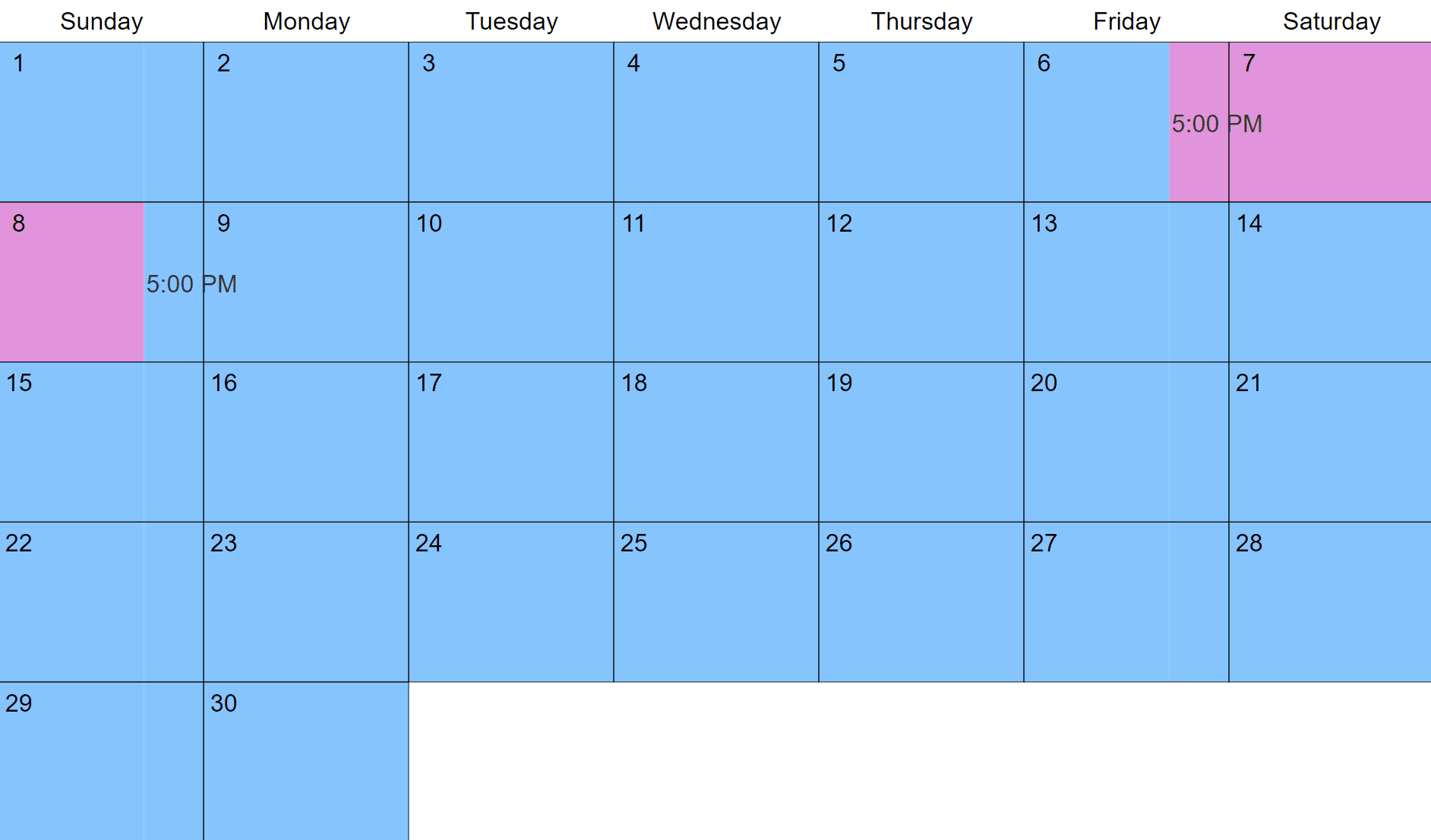

If either parent has signed a Release of Claim to Exemption for Child of Divorced or Separated Parents that individual will have essentially forfeited his or her right to claim the child as a dependent at tax time. The parent who has the majority of overnights in a given year gets to claim the children on their taxes. Typically when parents share 5050 custody they alternate between odd and even.

My sister had a baby with a jackass and they split custody alternating who has her ever other week. Who claims child on taxes with a 5050 custody split. If only one of you is the childs parent the child is treated as the qualifying child of the parent.

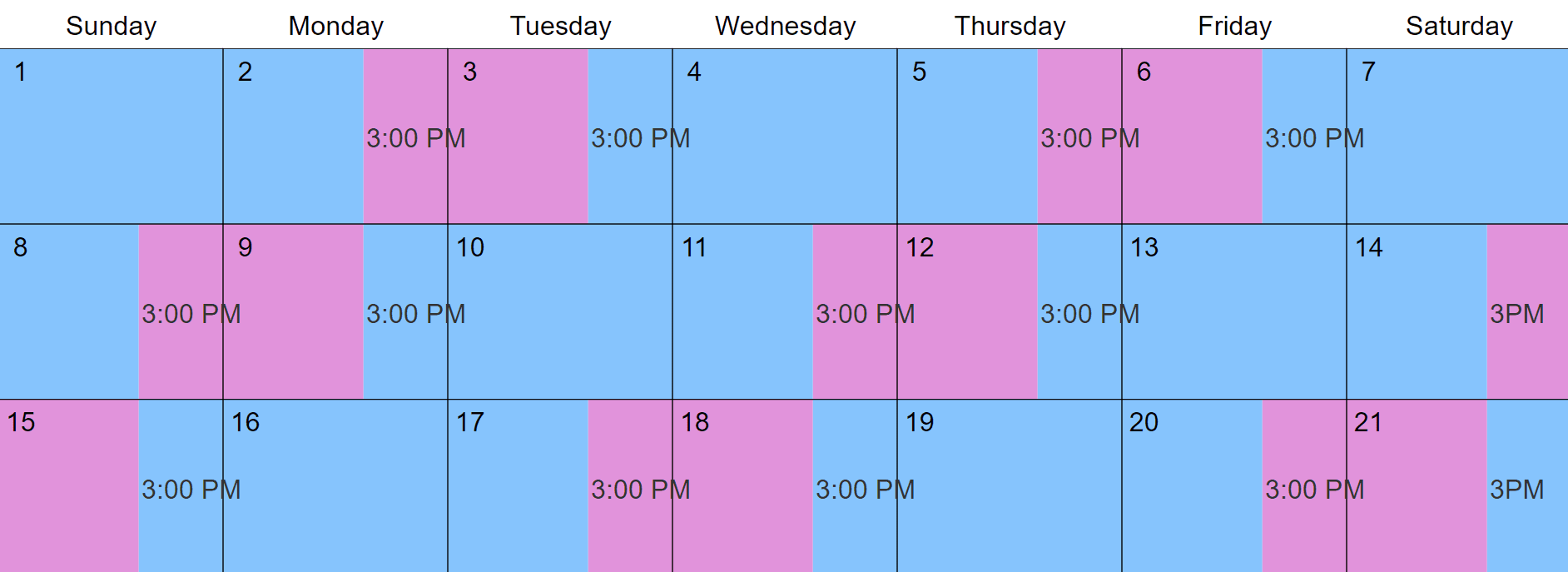

Who Claims the Child With 5050 Parenting Time. The custodial parent can transfer the exemption to the non-custodial parent by providing them with a signed copy of Form 8332. By default the IRS gives this right to the custodial parentthat is the parent with whom the child lives for more than half of the year.

In cases of 5050 custody this can and often does come down to one single overnight since most calendar years have an odd number of days. She cant get low income housing food stamps nothing. In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns.

In some cases divorced or unmarried couples work out their own arrangements such as those with multiple children dividing their children as dependents or those with only one child or an odd number of children alternating which years. As for taxes they split it. So one parent claims for the child one year and the other parent the next year.

As a result of split 5050 child custody agreements parents with high incomes can claim their children as dependent citizens. For a confidential consultation with an experienced child custody lawyer in Dallas contact Orsinger Nelson Downing Anderson LLP. But there is no option on tax forms for 5050 or joint custody.

The IRS explains Generally the custodial parent is the parent with whom the child lived for a longer period of time during the year. Equal The parent who qualifies as the custodial parent under federal tax law is the one who claims the children as dependents. Posted by udeleted 6 years ago.

Having a child may entitle you to certain deductions and credits on your yearly tax return. I provide more than 50 support and. So the parent with the higher adjusted gross income gets to claim the child as a dependent on their taxes even if they spend zero days per tax year with them.

He says his lawyer told him he gets to claim the child and my sister cant. Who claims child on taxes with a 5050 custody split. But if the custody agreement mandates that its a 5050 split then the parent with the higher adjusted gross income gets to claim it.

0 Reply SweetieJean Level 15 June 4 2019 317 PM We each have our child 5050. You will have to file an exemption Form 8332 as the custodial parent to gives permission to the non-custodial parent to claim the dependent exemption and Child Tax Credit. Only one parent can claim a dependent child in a given tax year when parents are not married and filing taxes.

Both parents cannot claim Head of Household only the custodial parent is allowed. The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household. Because she has 5050 custody.

He claims her one year she claims her one year. Mom works her butt off and has minimal money because she cant get any assistance at all. Well what about leap years youre asking yourself.

But there are ways to change the default rule and give child-related tax benefits to the non-custodial parent. If the non custodial parent submits the form 8862 to claim.

Infant Baby Parenting Plans Custody Schedules What Is Best

50 50 Joint Custody Who Pays Child Support

Who Claims A Child On Taxes In A 50 50 Custody Arrangement

70 30 Custody Visitation Schedules Most Common Examples

How To Create The Perfect Parenting Agreement With Examples

The Covid 19 Vaccine And Child Custody Conflict The Marks Law Firm

Does Joint Custody Mean Neither Parent Pays Child Support Renkin Law

Do I Have To Pay Child Support If I Share 50 50 Custody

Calculating Child Timeshare Custody Percentage Cristin Lowe Law

What Is Form 8332 Release Revocation Of Release Of Claim To Exemption For Child By Custodial Parent Turbotax Tax Tips Videos

Who Claims The Child With 50 50 Parenting Time Equal Griffiths Law

What Does A 50 50 Or Joint Custody Agreement Look Like

Long Distance Custody Visitation Schedule Examples Create Yours

70 30 Child Custody Schedules Top 4 Plans Timtab

Do I Have To Pay Child Support If I Share 50 50 Custody

Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer

Parenting Time Schedules In A Michigan Divorce